2016 is off to a rocky start. Fueled by China’s weakening currency, uncertain economy and volatile stock market, global markets have seen large drops in recent days. Things may well get worse before they get better.

China is the world’s second-largest economy, generating more than half of the global demand for resources over the past 10 years. The stock market crash in China has had a ripple effect on commodity prices, with crude oil prices recently dropping to their lowest levels since 2004.

The World Bank last week cut its global economic forecast for 2016, citing deeper contractions than expected in Brazil and Russia and weaker output in most of the world’s biggest economies, including the United States and China.

Looking Beyond Today’s News and Staying Invested

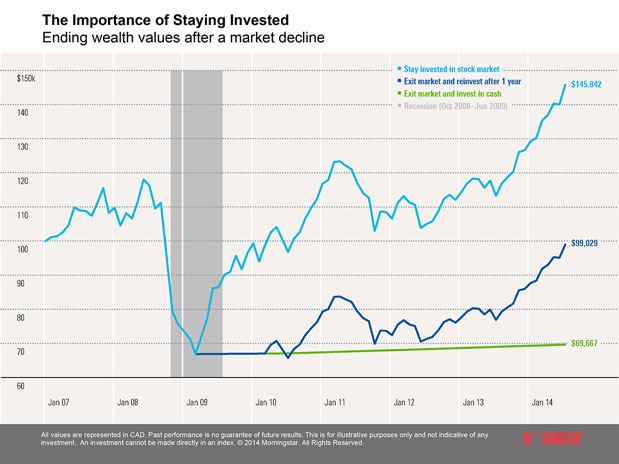

With Canadian stocks falling in recent days, many investors may find their discipline tested. Stock markets may continue to trend downward before they get better, so it’s easy to lose confidence and be tempted to get out of the market. The problem is that it’s not possible to accurately predict the best times to exit and enter the market. Investors who try to time the market run the risk of missing periods of exceptional returns, significantly detracting from the ending value of a portfolio. As history shows, staying invested is a much better strategy, as illustrated in the following chart.

Source: Morningstar

The chart illustrates the value of a $100,000 investment in the stock market from January 2007 to June 2014, which includes the financial crisis and subsequent recovery. The value of the investment dropped to $66,898 by February 2009, following a severe market decline. Had the investor remained invested in the stock market, the ending value of the investment would be $145,842. If the same investor exited the market at the bottom, invested in cash for a year, and then re-invested in the market, the ending value of the investment would be $99,029. An all-cash investment at the bottom of the market would have yielded only $69,667. As the chart shows, even though the continuous stock market investment was more volatile, in the end it provided a higher ending value. A strong argument for the value of staying invested for the long term.

How R Financial is Managing your Money

The volatile start to 2016 isn’t entirely unexpected. Over the course of the last year, instability in China, sharp price declines for energy and other commodities and widespread geopolitical unrest contributed to a great deal of market volatility. We expect slow economic growth and market volatility to continue into 2016, resulting in reduced return expectations.

At R Financial, we don’t chase performance – we know markets are unpredictable, so we build our portfolios to withstand market ups and downs. Our well-diversified portfolios are built to handle short-term volatility while delivering strong, long-term results consistent with investor goals and time horizons. Our professional money managers actively manage our funds and pools, making adjustments where necessary in response to events or market changes.

Talk to your Advisor

Market volatility shouldn’t cause you to panic. Rather, it’s a reminder to ensure your portfolio is well structured and your investments properly diversified.

For more information about market volatility, contact us at a time that is convenient for you.

Call 1-306-789-0028 or visit us at www.rfinancial.ca.